All Categories

Featured

Table of Contents

The needs likewise advertise innovation and progress through additional financial investment. Regardless of being certified, all investors still require to do their due persistance throughout the procedure of investing. 1031 Crowdfunding is a leading property investment platform for alternative financial investment lorries largely available to certified investors. Accredited financiers can access our choice of vetted financial investment opportunities.

With over $1.1 billion in securities marketed, the management team at 1031 Crowdfunding has experience with a vast array of investment structures. To access our total offerings, register for an investor account.

Accredited's workplace society has actually typically been We believe in leaning in to sustain improving the lives of our coworkers in the same way we ask each various other to lean in to passionately sustain enhancing the lives of our clients and community. We offer by using ways for our team to remainder and re-energize.

Expert Accredited Investor Opportunities

We also provide up to Our perfectly designated building consists of a health and fitness space, Relax & Relaxation rooms, and modern technology created to support adaptable work areas. Our ideal concepts come from working together with each other, whether in the office or working from another location. Our positive investments in innovation have allowed us to produce an allowing personnel to contribute anywhere they are.

If you have a rate of interest and feel you would certainly be a good fit, we would love to attach. Please ask at.

Best Best Opportunities For Accredited Investors Near Me (Oakland CA)

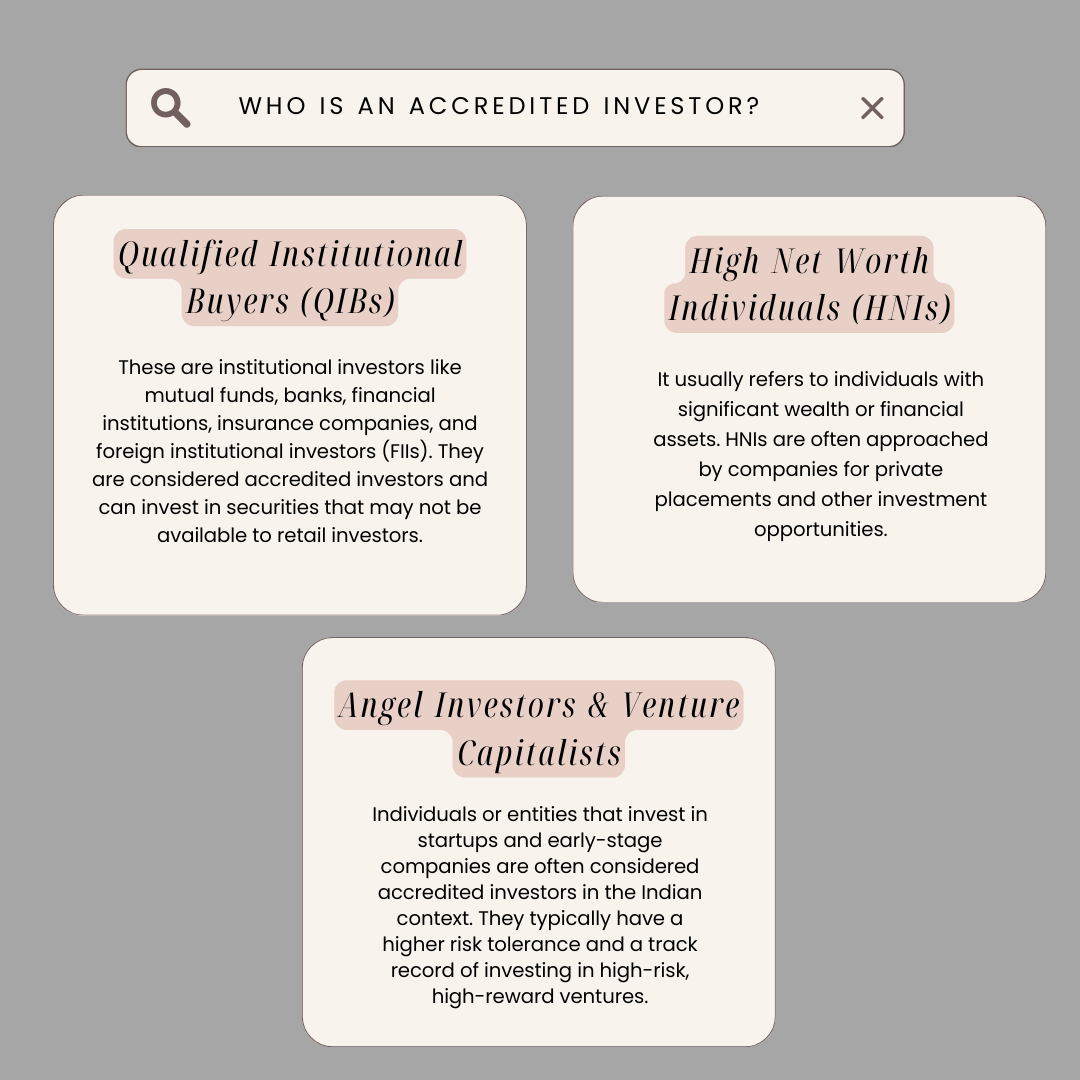

Accredited capitalists (in some cases called professional financiers) have accessibility to investments that aren't readily available to the general public. These investments might be hedge funds, difficult money car loans, exchangeable financial investments, or any various other security that isn't signed up with the financial authorities. In this write-up, we're mosting likely to concentrate particularly on realty financial investment alternatives for accredited capitalists.

This is every little thing you require to find out about actual estate investing for recognized capitalists (accredited crowdfunding). While anybody can buy well-regulated protections like supplies, bonds, treasury notes, mutual funds, and so on, the SEC is concerned about average investors getting right into financial investments past their ways or understanding. So, as opposed to permitting anybody to buy anything, the SEC produced a recognized capitalist criterion.

It's vital to remember that SEC guidelines for accredited financiers are designed to safeguard financiers. Without oversight from economic regulatory authorities, the SEC just can not evaluate the threat and reward of these investments, so they can't offer information to enlighten the average investor.

The idea is that investors that make enough earnings or have adequate wide range are able to take in the threat far better than capitalists with lower earnings or much less riches. As a recognized capitalist, you are expected to complete your own due persistance before including any kind of asset to your investment profile. As long as you fulfill among the following four needs, you certify as a recognized capitalist: You have actually made $200,000 or even more in gross earnings as a private, yearly, for the previous two years.

Comprehensive High Yield Investments For Accredited Investors (Oakland)

You and your spouse have had a combined gross income of $300,000 or more, each year, for the previous two years (returns for accredited investors). And you anticipate this level of earnings to continue.

Or all equity proprietors in the company qualify as accredited financiers. Being an accredited investor opens up doors to financial investment opportunities that you can not access or else.

Trusted Accredited Crowdfunding – Oakland

Coming to be a recognized investor is merely a matter of verifying that you fulfill the SEC's requirements. To confirm your revenue, you can offer documents like: Revenue tax returns for the previous two years, Pay stubs for the previous 2 years, or W2s for the past 2 years. To confirm your internet well worth, you can provide your account declarations for all your assets and liabilities, including: Cost savings and checking accounts, Investment accounts, Exceptional fundings, And property holdings.

You can have your lawyer or certified public accountant draft a verification letter, confirming that they have actually assessed your financials which you fulfill the demands for a certified capitalist. Yet it might be a lot more economical to make use of a solution particularly created to validate certified financier standings, such as EarlyIQ or .

Secure Accredited Investor Real Estate Deals

, your certified investor application will certainly be refined with VerifyInvestor.com at no expense to you. The terms angel financiers, advanced financiers, and approved financiers are frequently made use of interchangeably, however there are subtle differences.

Usually, any person who is approved is assumed to be a sophisticated investor. The income/net worth demands stay the exact same for foreign investors.

Here are the finest financial investment chances for accredited investors in actual estate.

Some crowdfunded realty investments don't call for accreditation, however the jobs with the biggest possible incentives are normally scheduled for recognized capitalists. The difference in between tasks that approve non-accredited capitalists and those that just approve recognized financiers normally comes down to the minimal investment amount. The SEC currently restricts non-accredited investors, who make much less than $107,000 each year) to $2,200 (or 5% of your annual revenue or internet well worth, whichever is much less, if that amount is more than $2,200) of financial investment capital annually.

Table of Contents

Latest Posts

Government Tax Foreclosures

Houses For Tax Sale

Tax Liens Homes For Sale

More

Latest Posts

Government Tax Foreclosures

Houses For Tax Sale

Tax Liens Homes For Sale